Beyond the Panic: How the Venezuela Crisis Could Help, Not Hurt, India’s Oil Story

Rabbit Invest: The Ultimate Mutual Fund Distributor Software Venezuela is not a significant oil problem for India at present, but it could quietly alter India’s oil options in the next few years. India purchases little oil from Venezuela today, so the current crisis is more about short‑term market volatility and long‑term opportunities than an immediate […]

India’s IPO Boom: Are Households Prepared for the Risks?

IPO Fever, But Underlying Losses Deepen India’s mainboard and SME IPOs shattered fundraising and listing records in 2024-25. According to the SEBI Annual Report 2024-25, public equity monetisation, including initial public offers (IPOs), follow-on public offers (FPOs), and rights issues, raised about Rs. 2.1 lakh crore, an increase of 2.5 times from the previous year. […]

India’s Mutual Fund Boom is Creating Big Opportunities for MFDs

India’s mutual fund industry is undergoing a historic transformation, not just in size but also in depth and diversity. With assets under management (AuM) tripling to ₹65.7 lakh crore in five years and retail investors crossing 5.4 crore in 2025, the market is expanding faster than ever. But the real story for distributors lies beyond […]

How Can MFDs in India Target Gen Z to Invest Smartly?

Mutual fund distributors (MFDs) in India are entering a new era. The country’s next targeted investor base is no longer young professionals in their thirties; it’s Gen Z. However, winning the confidence of the country’s fastest-growing but most fickle investor generation is challenging. Let’s quickly break down what makes this generation different, why they matter, […]

India’s Rupee Trade Revolution

How INR Settlements Are Transforming Geopolitics, Macroeconomics, and Market Prospects India’s recent push to settle more international trade transactions in the rupee (INR), rather than the US dollar or other foreign currencies, amid rising geopolitical tensions with the US, is reshaping its geopolitical stance. Macroeconomic fundamentals and the prospects for India’s domestic industries and mutual […]

Specialized Investment Funds (SIFs) in India

The New Frontier for Advanced Investors: Part 2 Read More on What are Specialized Investment Funds and its advantage in the Indian context? AIFs vs SIFs vs Traditional Mutual Funds Mutual funds are the simplest set of pooled investment vehicles that SEBI stringently controls and regulates, offering exposure to a broader set of asset classes such as […]

Specialized Investment Funds (SIFs) in India

The New Frontier for Advanced Investors: Part-1 The Indian investment landscape has evolved dynamically, and Specialized Investment Funds (SIFs) have emerged as the latest investment tool for seasoned investors participating in financial markets. For those looking for a midway between traditional mutual funds (that pool in money from many investors into a common strategy) and […]

The Latest US Tariffs: Market Ripple Effects for India & MFDs

Introduction: The New Tariff Landscape The 2025 US tariff regime, which involves the imposition of reciprocal tariff duties as high as 26% on Indian exports, has redefined and reshaped the India-US trade landscape and the Indian market. With negotiations ongoing and deadlines to reach a mutually favorable agreement between the two nations extended, Indian exporters […]

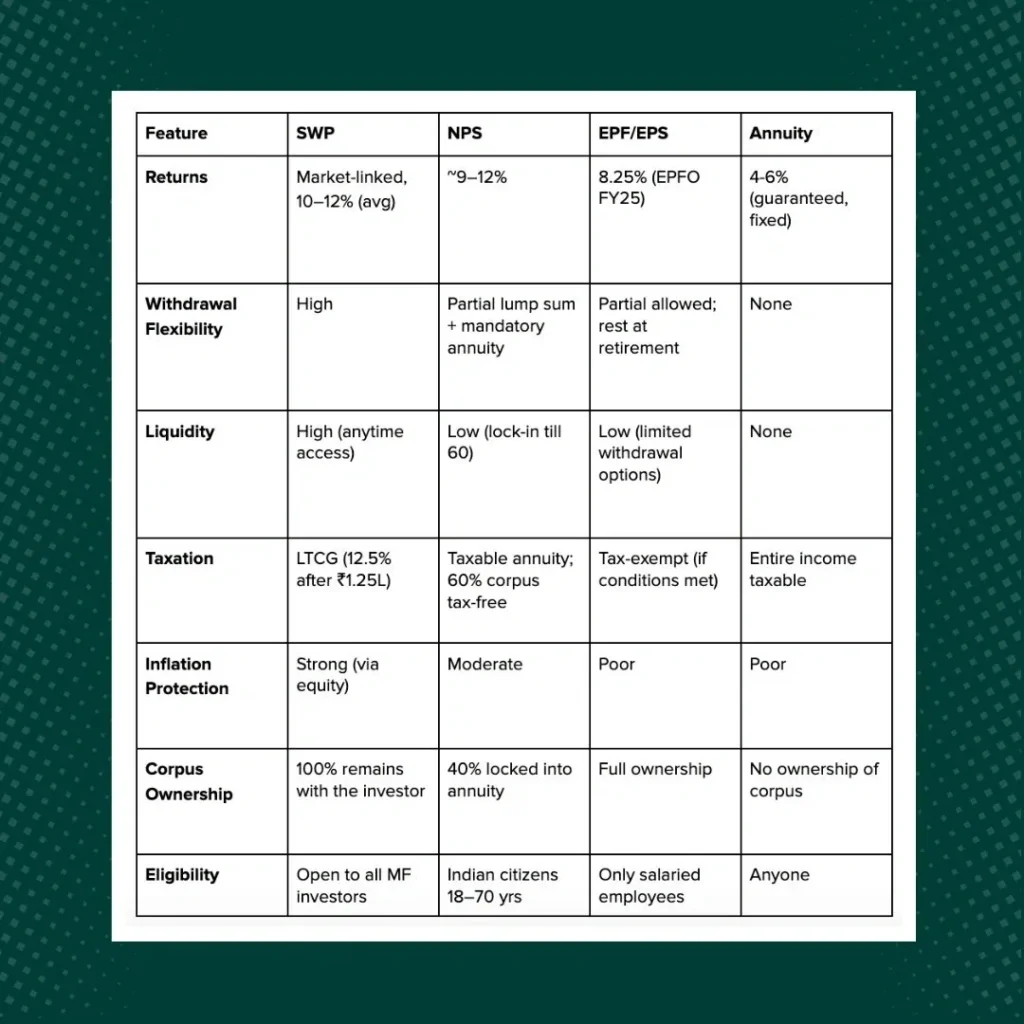

Is SWP the New Solution to Pension Planning?

A Strategic Guide for Mutual Fund Distributors ~ Helping MFDs position SWPs as a flexible, inflation-ready retirement strategy The retirement planning landscape in India is undergoing a significant shift. Traditional pension schemes, such as the Employees’ Pension Scheme (EPS) and the National Pension System (NPS), as well as fixed-income annuities, are no longer sufficient for individuals […]

Building a Good Mutual Fund Distribution Business in 2025

A Comprehensive Guide The mutual fund distribution business in India is on a rise like never before. With the Indian mutual fund industry’s Assets Under Management (AUM) crossing a staggering ₹72.2 lakh crore as of May 2025, the sector has witnessed a six-fold growth in just a decade. This phenomenal expansion, driven by rising financial […]