A Strategic Guide for Mutual Fund Distributors ~ Helping MFDs position SWPs as a flexible, inflation-ready retirement strategy

The retirement planning landscape in India is undergoing a significant shift. Traditional pension schemes, such as the Employees’ Pension Scheme (EPS) and the National Pension System (NPS), as well as fixed-income annuities, are no longer sufficient for individuals seeking inflation-adjusted, flexible retirement income. This is where Systematic Withdrawal Plans (SWPs) are stepping in as a modern, inflation-adjusted alternative. Mutual Fund Distributors (MFDs) now have a powerful tool to reinvent pension planning for their clients – one that offers control, liquidity, and inflation-ready growth potential.

What Is a Systematic Withdrawal Plan (SWP)?

A Systematic Withdrawal Plan (SWP) enables investors to withdraw a fixed amount regularly from their mutual fund investments, while the remaining corpus remains invested. This helps generate a steady cash flow, when needed, while the remaining capital earns returns through the market. Withdrawals can be customised (monthly, quarterly, annually), and investors have full ownership and access to their funds.

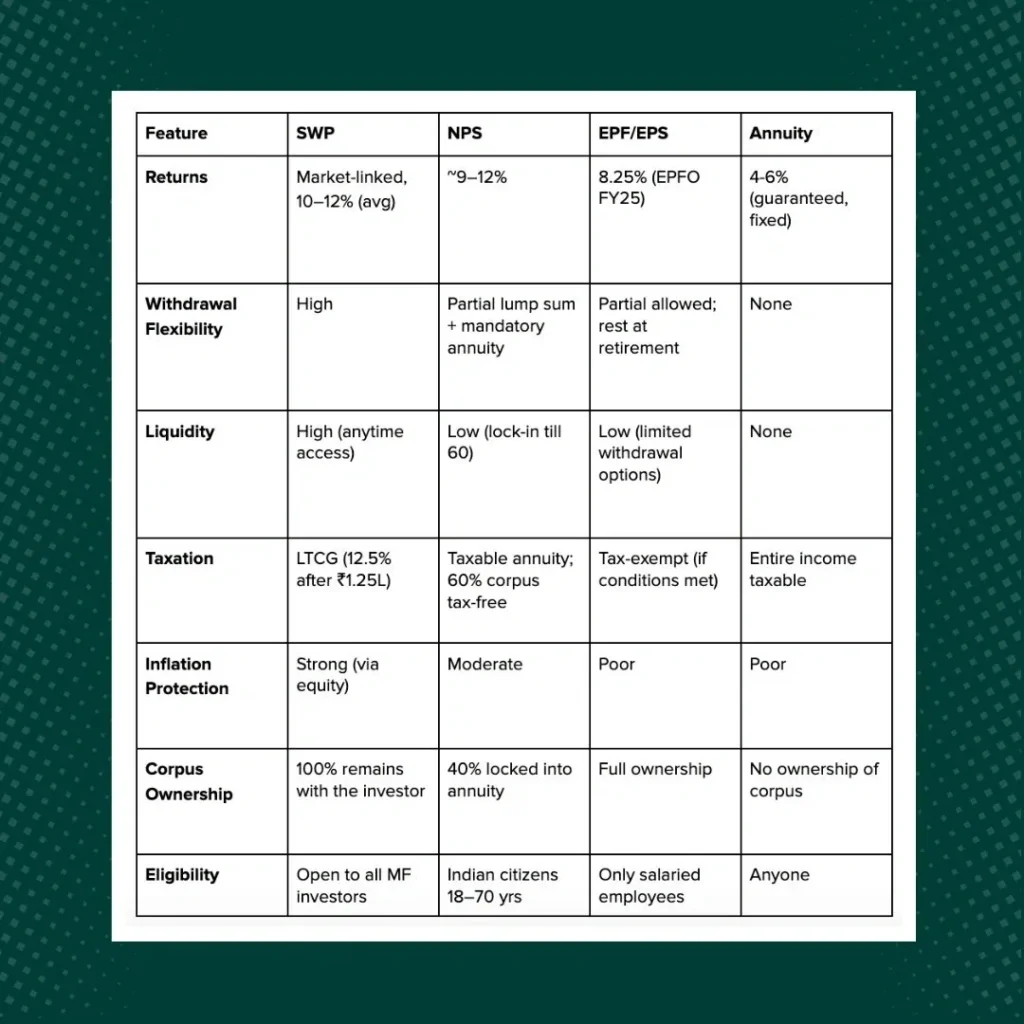

How Does SWP Compare with Traditional Pension Tools?

SWP vs. NPS: While NPS offers good returns, 40% of the corpus must be used to buy an annuity. SWP offers complete flexibility with full corpus access and better tax control.

SWP vs. EPF/EPS: EPF interest (8.25% in FY25) is safe but often fails to beat inflation. SWPs in hybrid or equity mutual funds have historically delivered higher post-tax real returns.

SWP vs. Annuities: Annuities offer guaranteed income but low returns and poor liquidity. SWPs allow growth and full access to funds.

Why SWP Is Emerging as the Smarter Retirement Option

A. Control and Flexibility: Clients determine the amount to withdraw and when, with full access to the corpus.

B. Inflation-Adjusted Growth: Equity-oriented funds used in SWPs have historically delivered a 10–12% CAGR, outperforming inflation.

C. Tax Efficiency: Unlike annuities (fully taxable), SWP withdrawals are taxed only on capital gains, with ₹1.25 lakh in LTCG tax-free annually.

D. Predictable Cash Flow: Can be tailored to monthly income needs – mirroring pension payouts, but with relatively better returns.

Data-Backed Trends Supporting SWP

- Mutual Fund Inflows: According to AMFI, monthly SIP contributions reached ₹27,269 crore in June 2025, indicating strong trust in mutual fund investments.

- EPFO Rates Stagnant: EPFO fixed interest at 8.25% for FY25, below historical inflation rates.

- NPS Returns: According to PFRDA, the average 10-year returns for NPS equity schemes are ~10.5%, but the annuity requirement remains a constraint.

With these numbers, you, as trusted MFDs, can clearly demonstrate the performance edge and flexibility offered by SWPs to your investors.

Conclusion

Systematic Withdrawal Plans represent how pension planning has evolved over time, giving investors autonomy, growth, and flexibility. As trusted advisors, Mutual Fund Distributors are ideally placed to lead this shift. By recommending SWPs as part of a holistic retirement strategy, MFDs can not only deliver superior outcomes, returns, and financial benefits for their clients but also strengthen their advisory proposals in a growing retirement-focused market.

“SWP is not just another product – it’s a powerful pension alternative in your advisory endeavors.”